The 10-Second Trick For Eb5 Investment Immigration

Table of ContentsThe 3-Minute Rule for Eb5 Investment ImmigrationSome Of Eb5 Investment ImmigrationSome Known Incorrect Statements About Eb5 Investment Immigration Eb5 Investment Immigration - TruthsLittle Known Questions About Eb5 Investment Immigration.

While we aim to supply precise and up-to-date content, it must not be considered legal guidance. Migration regulations and regulations are subject to change, and individual circumstances can vary commonly. For customized support and lawful suggestions concerning your certain migration scenario, we highly advise speaking with a qualified immigration attorney who can offer you with tailored aid and guarantee compliance with current laws and policies.

Citizenship, through financial investment. Presently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Locations and Country Areas) and $1,050,000 in other places (non-TEA areas). Congress has accepted these amounts for the following 5 years starting March 15, 2022.

To get the EB-5 Visa, Investors need to develop 10 full-time U.S. jobs within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that financial investments add straight to the united state work market. This uses whether the work are produced straight by the commercial enterprise or indirectly under sponsorship of an assigned EB-5 Regional Facility like EB5 United

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

These jobs are established with designs that use inputs such as growth prices (e.g., construction and tools expenditures) or annual revenues produced by recurring operations. In contrast, under the standalone, or straight, EB-5 Program, only direct, permanent W-2 worker positions within the commercial venture might be counted. A vital threat of relying solely on straight staff members is that personnel decreases because of market problems can cause inadequate permanent placements, possibly causing USCIS rejection of the capitalist's application if the job development demand is not met.

The financial design after that projects the variety of straight tasks the new business is likely to create based on its anticipated revenues. Indirect tasks calculated with economic models describes employment produced in markets that supply the goods or services to the service directly associated with the job. These jobs are produced as a result of the enhanced demand for items, products, or services that sustain business's procedures.

Eb5 Investment Immigration Fundamentals Explained

An employment-based 5th choice category (EB-5) investment visa offers a method of becoming an irreversible U.S. homeowner for international nationals wanting to invest resources in the United States. In order to get this eco-friendly card, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or maintain at the very least 10 full time work for United States workers (excluding the capitalist and their immediate household).

This measure has actually been an incredible success. Today, 95% of all EB-5 capital is increased and spent by Regional Centers. Because the 2008 economic crisis, access to funding has actually been restricted and municipal budget plans proceed to face substantial deficiencies. In several regions, EB-5 financial investments have actually filled up the financing gap, giving a new, important resource of funding for neighborhood economic advancement jobs that renew communities, develop and support tasks, framework, and solutions.

The 25-Second Trick For Eb5 Investment Immigration

Even more than 25 countries, consisting of Australia and the United Kingdom, usage similar programs to bring in foreign financial investments. The American program is more strict than many others, calling for significant risk for investors in terms of both their financial investment and migration condition.

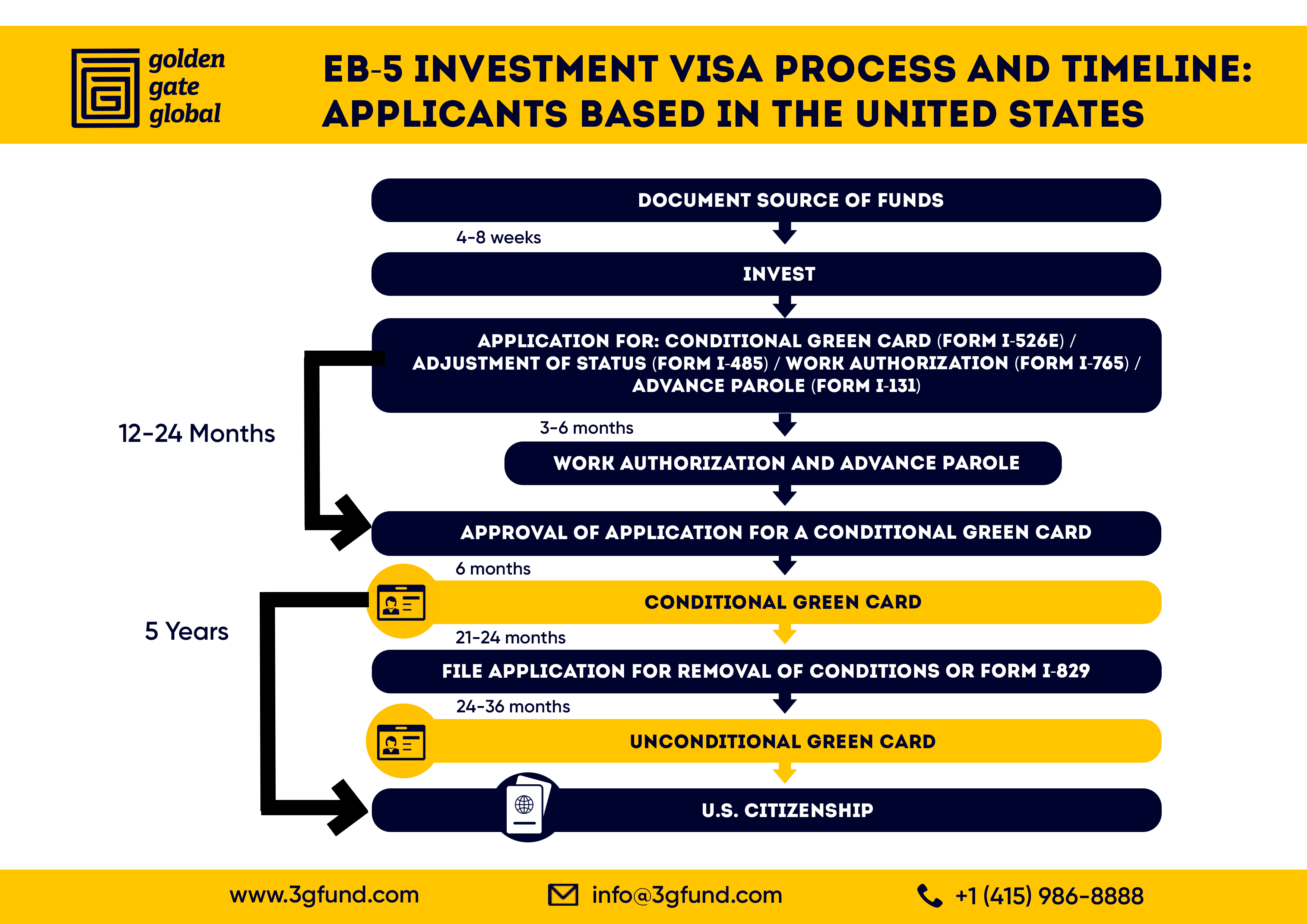

Households and individuals that look for to relocate to the United States on a permanent basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Provider (U.S.C.I.S.) established out numerous requirements to acquire permanent residency through the EB-5 visa program.: The very first action is to find a certifying investment opportunity.

When the chance has actually been recognized, the look at here now investor needs to make the investment and submit an I-526 request to the united state Citizenship and Migration Provider (USCIS). This request must consist of proof of the investment, such as financial institution statements, acquisition agreements, and company plans. The USCIS will evaluate the I-526 request and either approve it or request added proof.

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

The financier must obtain conditional residency by submitting an I-485 application. This request needs to be submitted within 6 months of the I-526 approval and must include proof that the financial investment was made and that it has actually produced a minimum of 10 full time jobs for united state workers. The USCIS will certainly examine the I-485 petition and either accept it or request added evidence.